Financial Times is reporting some problems for Simon Sadler’s finance company Segantii in Hong Kong with some big banks pulling out of some forms of business with them. To be honest I don’t really understand it. Anyone know what’s going on? And should we be in any way…….worried?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Segantii

- Thread starter philmus

- Start date

Insider

Well-known member

Read the thread on it from a couple of weeks back. There's some helpful information but the best bit of advice is don't panic and all this happened 18 months ago.Financial Times is reporting some problems for Simon Sadler’s finance company Segantii in Hong Kong with some big banks pulling out of some forms of business with them. To be honest I don’t really understand it. Anyone know what’s going on? And should we be in any way…….worried?

WIZARD OF TANGERINE

Well-known member

Yes I think we should as I read in respect to the signing of Kirk there was a financial problem of Blackpool stumping up the money.Financial Times is reporting some problems for Simon Sadler’s finance company Segantii in Hong Kong with some big banks pulling out of some forms of business with them. To be honest I don’t really understand it. Anyone know what’s going on? And should we be in any way…….worried?

bollieboy

Well-known member

2 + 2 = 5495Yes I think we should as I read in respect to the signing of Kirk there was a financial problem of Blackpool stumping up the money.

Albert Ross

Well-known member

A financial problem in finding £500,000 yet committing to a spend of £30 million on infrastructure, I don’t think so. As has been said on other threads, it’s not can’t pay so much as won’t pay.Yes I think we should as I read in respect to the signing of Kirk there was a financial problem of Blackpool stumping up the money.

JJpool

Well-known member

Yep 18 months ago...

Anothe ft article

www.ft.com

www.ft.com

But also this one...

www.efinancialcareers.com

www.efinancialcareers.com

To most investment banks Segantii Capital Management is known as one of the most active hedge funds in Hong Kong, where it's a go-to fund for banks looking to trade in Asia.

That could change after it was claimed that Bank of America and Citi suspended trading with the fund, which was launched by ex-banker Simon Sadler in 2007.

According to the FT, Bank of America and Citigroup suspended equity trading with Segantii Capital Management, due concerns about the hedge fund’s bets on the sale of large blocks of shares. The banks were said by the FT to be reducing their exposure to Segantii as US authorities have launched an investigation into block trading at several Wall Street financial institutions.

However, the FT's claims are disputed and we understand that Segantii is working with all banks. A source close to the firm says Segantii is still an active client of both Citi and Bank of America, is operating as usual and is hiring in Hong Kong. A prime broker at a European bank in Hong Kong told the FT that Segantii is a “priority customer for the entire Street” in Asia.

Anothe ft article

Simon Sadler: Blackpool’s block trade king

Segantii Capital boss was a favourite customer for Hong Kong banks but Citi and BofA have halted equity trading

www.ft.com

www.ft.com

But also this one...

Segantii Capital's ex-bankers are still hiring in Hong Kong

Meet the bankers running Hong Kong's top hedge fund.

www.efinancialcareers.com

www.efinancialcareers.com

To most investment banks Segantii Capital Management is known as one of the most active hedge funds in Hong Kong, where it's a go-to fund for banks looking to trade in Asia.

That could change after it was claimed that Bank of America and Citi suspended trading with the fund, which was launched by ex-banker Simon Sadler in 2007.

According to the FT, Bank of America and Citigroup suspended equity trading with Segantii Capital Management, due concerns about the hedge fund’s bets on the sale of large blocks of shares. The banks were said by the FT to be reducing their exposure to Segantii as US authorities have launched an investigation into block trading at several Wall Street financial institutions.

However, the FT's claims are disputed and we understand that Segantii is working with all banks. A source close to the firm says Segantii is still an active client of both Citi and Bank of America, is operating as usual and is hiring in Hong Kong. A prime broker at a European bank in Hong Kong told the FT that Segantii is a “priority customer for the entire Street” in Asia.

TKL_Seasider

Well-known member

Tallies with a couple of things I’ve heard. Segantii has scaled up in quite a big way and of course that doesn’t come without problems. But the FT report may have been … a little more dramatic than it needed to be.Yep 18 months ago...

Anothe ft article

Simon Sadler: Blackpool’s block trade king

Segantii Capital boss was a favourite customer for Hong Kong banks but Citi and BofA have halted equity tradingwww.ft.com

But also this one...

Segantii Capital's ex-bankers are still hiring in Hong Kong

Meet the bankers running Hong Kong's top hedge fund.www.efinancialcareers.com

To most investment banks Segantii Capital Management is known as one of the most active hedge funds in Hong Kong, where it's a go-to fund for banks looking to trade in Asia.

That could change after it was claimed that Bank of America and Citi suspended trading with the fund, which was launched by ex-banker Simon Sadler in 2007.

According to the FT, Bank of America and Citigroup suspended equity trading with Segantii Capital Management, due concerns about the hedge fund’s bets on the sale of large blocks of shares. The banks were said by the FT to be reducing their exposure to Segantii as US authorities have launched an investigation into block trading at several Wall Street financial institutions.

However, the FT's claims are disputed and we understand that Segantii is working with all banks. A source close to the firm says Segantii is still an active client of both Citi and Bank of America, is operating as usual and is hiring in Hong Kong. A prime broker at a European bank in Hong Kong told the FT that Segantii is a “priority customer for the entire Street” in Asia.

There’s another big article in today’s FTRead the thread on it from a couple of weeks back. There's some helpful information but the best bit of advice is don't panic and all this happened 18 months ago.

TKL_Seasider

Well-known member

Interesting read, but no new news here. Couple of interesting snippets

12ft.io

12ft.io

Segantii has not been accused of wrongdoing and it is not known if it has been contacted as part of the US block trades probe, but the banks’ moves were a rare roadblock for 52-year-old Sadler, whose ambitious risk-taking has reaped large rewards, both at his hedge fund and elsewhere.

Sadler and his family relocated from Hong Kong to London during the pandemic, according to three people that know him. He has “pulled back” from Segantii’s main base in Hong Kong in the past few years, one of the people said, partly because of the focus on his football team.

A third executive, formerly a senior prime broker, said Sadler was “a tough character but I find him very fair. I go into each negotiation with him thinking ‘how little can I lose in this?’”

12ft |

Segantii has not been accused of wrongdoing and it is not known if it has been contacted as part of the US block trades probe, but the banks’ moves were a rare roadblock for 52-year-old Sadler, whose ambitious risk-taking has reaped large rewards, both at his hedge fund and elsewhere.

Sadler and his family relocated from Hong Kong to London during the pandemic, according to three people that know him. He has “pulled back” from Segantii’s main base in Hong Kong in the past few years, one of the people said, partly because of the focus on his football team.

A third executive, formerly a senior prime broker, said Sadler was “a tough character but I find him very fair. I go into each negotiation with him thinking ‘how little can I lose in this?’”

Lytham_fy8

Well-known member

Doesn't appear to be much cashflow problem with financing the the new training ground though.Yes I think we should as I read in respect to the signing of Kirk there was a financial problem of Blackpool stumping up the money.

traffordtang

Well-known member

Could this be down to a competitor trying to cause a bit of trouble?

Hazi

Well-known member

Give over, Kirk didn’t pull up any trees we like him but he needs work and nowhere near there first team. No other champ clubs in for him so we are trying to knock a bit offYes I think we should as I read in respect to the signing of Kirk there was a financial problem of Blackpool stumping up the money.

Mark_GT

Well-known member

One thing seems to be certain. Simon S will not pay over the odds for anything. That'll do me. There are already enough over moneyed idiots in football and we can do well by having a top negotiator trading against them.Give over, Kirk didn’t pull up any trees we like him but he needs work and nowhere near there first team. No other champ clubs in for him so we are trying to knock a bit off

Adams Kebab

Well-known member

That’s the legacy of Joe NuttallOne thing seems to be certain. Simon S will not pay over the odds for anything. That'll do me. There are already enough over moneyed idiots in football and we can do well by having a top negotiator trading against them.

Mark_GT

Well-known member

Good point. Trust them once, then do it yourselfThat’s the legacy of Joe Nuttall

Philbfctrois

Well-known member

Karl Oyston was also a top negotiatorOne thing seems to be certain. Simon S will not pay over the odds for anything. That'll do me. There are already enough over moneyed idiots in football and we can do well by having a top negotiator trading against them.

Mexboroseasider

Well-known member

Not really. He lost out on opportunities because of belligerence and because he needed to be seen as the winnerKarl Oyston was also a top negotiator

There is a difference.

Philbfctrois

Well-known member

He was a winner for a long time with his penny pinching waysNot really. He lost out on opportunities because of belligerence and because he needed to be seen as the winner

There is a difference.

He was also a trailblazer in the way he dealt with agents and with the clauses he put in player contracts

Old_Laytonian

Well-known member

I think the FT has an axe to grind or it’s quiet time of the year for financial news

Mexboroseasider

Well-known member

Well he had success in a few negotiations I might agree.He was a winner for a long time with his penny pinching ways

He was also a trailblazer in the way he dealt with agents and with the clauses he put in player contracts

I’m not sure “trailbrazer” takes in the full picture of how agents are (and were regarded) but I don’t disagree that agents often take the piss.

But his flaw was that his ego took over and he had to be seen to win.

First question of a client in any negotiation is “what do you want? If you get that then you’ve won, even if people don’t see it or think you’ve lost”.

If the answer to the question “what do you want?” is “I want everyone to know I’ve won even if I lose” then that’s different. You know you’re representing a child. And stroke their egos accordingly. And then present your bill. With money on account hopefully.

Mark_GT

Well-known member

He certainly had his moments with his line on agents etc but ruined it all by being an obnoxious self regarding tit. Made himself quite popular for a while with some of the other club chairs though it seems. Probably took them blasting away at birds on his mrs's estate, that tickled Holloway's g spot for sure.Karl Oyston was also a top negotiator

voyeur

Well-known member

Cos he had the massive advantage of not really wanting to seal any deals and not giving a toss about success or failure on the pitch.Karl Oyston was also a top negotiator

Last edited:

Mexboroseasider

Well-known member

“He was a winner for a long time with his penny pinching ways”

That is something Karl Oyston is most certainly not

A winner

Revenue.

And.

Costs.

Karl The Genius focused only on one side. And had an occasional win.

JJpool

Well-known member

Did you see his haircut, didn't do very well with negotiating with the barber so he had to use a bowl himself?Karl Oyston was also a top negotiator

voyeur

Well-known member

The barber went into the negotiations with three options and Karl ended up with the bowl.Did you see his haircut, didn't do very well with negotiating with the barber so he had to use a bowl himself?

JJpool

Well-known member

The barber went into the negotiations with three options and Karl ended up with the bowl.

Wizaard

Well-known member

Yes, you've always sung his praisesHe was a winner for a long time with his penny pinching ways

He was also a trailblazer in the way he dealt with agents and with the clauses he put in player contracts

SwannDangerous

Well-known member

He was definitely good at some things, but in the end the rot had gone too far and turned his shrewd business approach into mere vindictive bullying of staff and fans. I think SS may share some similar qualities with the Karl in terms of his hard negotiation tactics, but I think his love for the club as a supporter will keep him on the right path. I also think SS, hard negotiator he may be, is definitely still a pleasant person to deal with, whereas Karl was rude and downright derogatory to most people he dealt with.He was a winner for a long time with his penny pinching ways

He was also a trailblazer in the way he dealt with agents and with the clauses he put in player contracts

I feel like you've blocked me so I'm not expecting a response

Philbfctrois

Well-known member

I haven't blocked anyoneHe was definitely good at some things, but in the end the rot had gone too far and turned his shrewd business approach into mere vindictive bullying of staff and fans. I think SS may share some similar qualities with the Karl in terms of his hard negotiation tactics, but I think his love for the club as a supporter will keep him on the right path. I also think SS, hard negotiator he may be, is definitely still a pleasant person to deal with, whereas Karl was rude and downright derogatory to most people he dealt with.

I feel like you've blocked me so I'm not expecting a response

voyeur

Well-known member

We were shit under Karl, except when Val starting pulling a few strings and buying things. Let's not warp history. Steve McMahon might have made a silk purse out of a sow's ear, but it was still a sow's ear, with a zip and no money in it. And McMahon bought the zip himself.

Micky Walsh

Well-known member

Didn't want to pay the fee and not stumping up?Yes I think we should as I read in respect to the signing of Kirk there was a financial problem of Blackpool stumping up the money.

LA1 Seasider

Well-known member

I’m not really sure that SS will have an awful lot to do with the negotiations which go on between BFC and any other clubs or agents. That’s what Mansford is at the club for. Mansford who has been an agent, football specialist lawyer and CEO is most definitely best placed for that role. SS will give the sign off as and when necessary but successful business people know when and where to be involved and when and where to let other specialists take over. That’s very much where Koko fell down. Needless to say he wasn’t a successful business person !

Yep, Karl didn't negotiate. Which is why we lost out on Champions League winner Mehdi Benatia who was sold 21 million. And England striker Jamie Vardy. Why we didn't get Dobbie in the Premier League. Why we didn't get DJ Campbell back and instead he went to Ipswich on loan and scored 10 in 17 which led to Holloway packing it in. It's why no reputable manager would touch us with a bargepole afterwards.Not really. He lost out on opportunities because of belligerence and because he needed to be seen as the winner

There is a difference.

I'm not sure what Karl's' negotiations ever got us. We lost most of our best players for nothing. Vaughan, Crainey, GTF etc. Other than Adam, the spine of that team walked for nothing. We botched selling Ince, although got a good deal for Phillips.

That being said, we were rarely "burdened" with a player, and I like the usage of team options (very common place now"). But to call Karl a trialblazer with agents...well that would require other teams to copy him. And they didn't. Because they know holding your nose and overpaying agents is a small price to pay. And I don't praise contracts solely for stopping us overpaying old players looking for one last pay day. That should come with scouting too, which we didn't have at all, and a general club ethos of looking to buy young players.

Insider

Well-known member

Please refrain from posting anything factual on this messageboard. You just spoil everything.Yep, Karl didn't negotiate. Which is why we lost out on Champions League winner Mehdi Benatia who was sold 21 million. And England striker Jamie Vardy. Why we didn't get Dobbie in the Premier League. Why we didn't get DJ Campbell back and instead he went to Ipswich on loan and scored 10 in 17 which led to Holloway packing it in. It's why no reputable manager would touch us with a bargepole afterwards.

I'm not sure what Karl's' negotiations ever got us. We lost most of our best players for nothing. Vaughan, Crainey, GTF etc. Other than Adam, the spine of that team walked for nothing. We botched selling Ince, although got a good deal for Phillips.

That being said, we were rarely "burdened" with a player, and I like the usage of team options (very common place now"). But to call Karl a trialblazer with agents...well that would require other teams to copy him. And they didn't. Because they know holding your nose and overpaying agents is a small price to pay. And I don't praise contracts solely for stopping us overpaying old players looking for one last pay day. That should come with scouting too, which we didn't have at all, and a general club ethos of looking to buy young players.

seasideone

Well-known member

In all my years in business this is what I think is the secret to success ……

Know what your purpose is and then surround yourself with people better than you who believe in it and get them to deliver it ….. and very importantly - let them get on with it

Know what your purpose is and then surround yourself with people better than you who believe in it and get them to deliver it ….. and very importantly - let them get on with it

Hazi

Well-known member

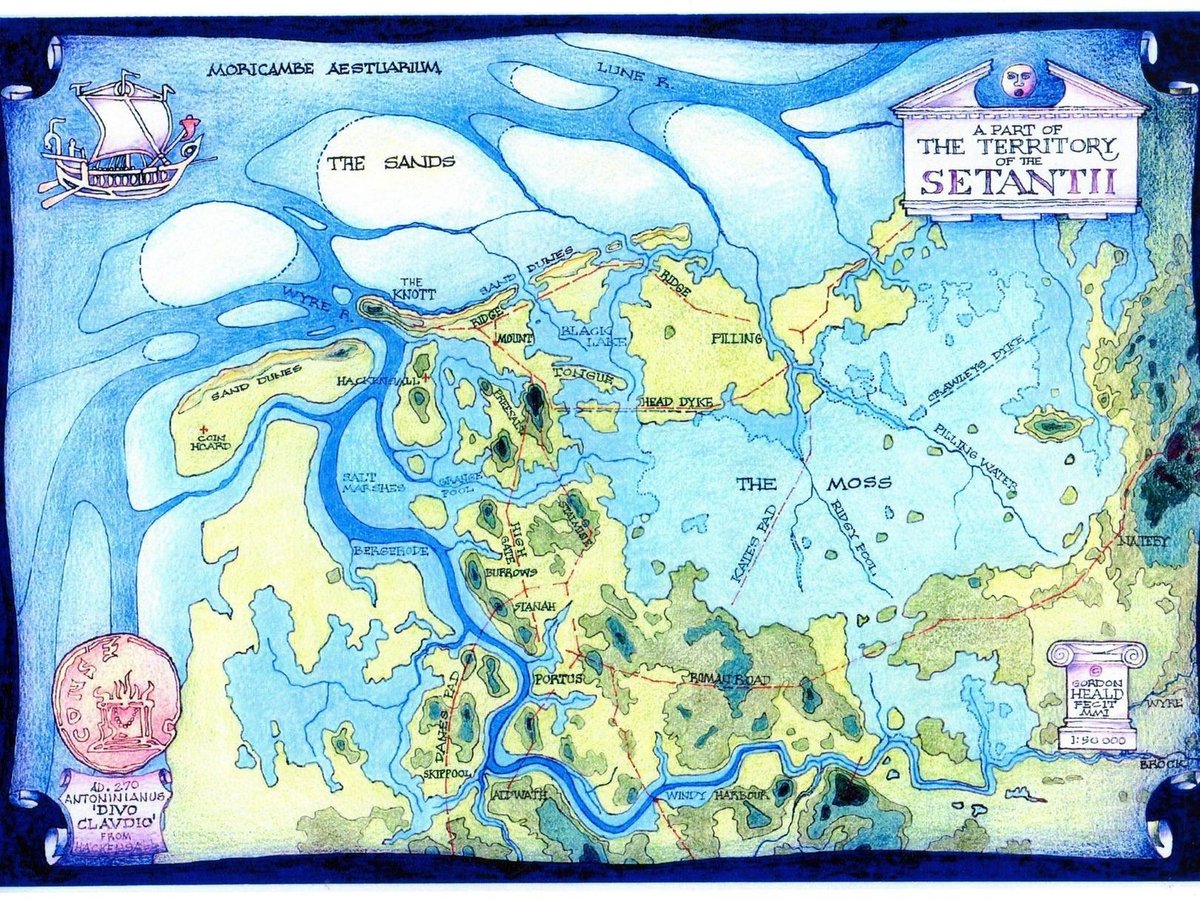

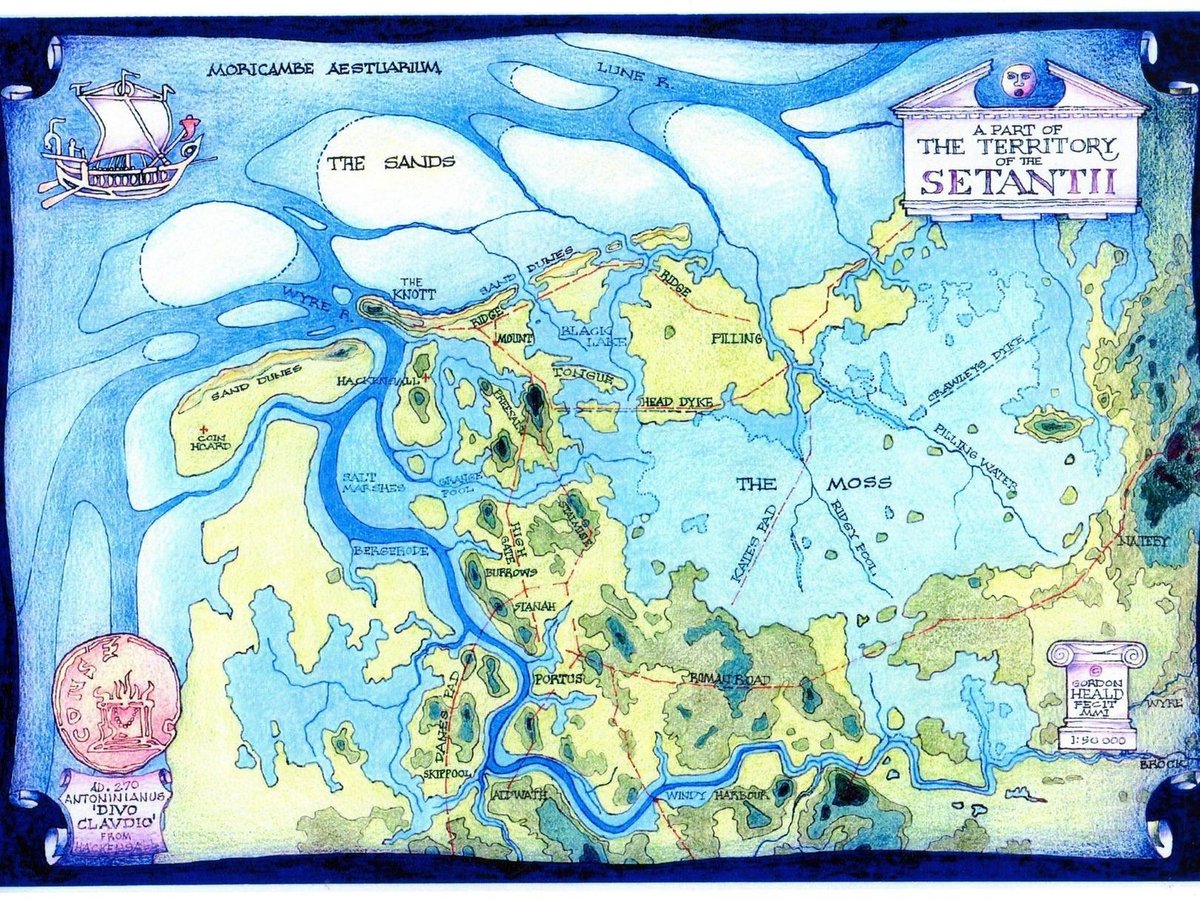

For over a decade, bankers in Hong Kong wanting to sell large blocks of a company’s shares have jostled for the attention of Blackpool-born businessman Simon Sadler. Sadler’s $6bn hedge fund Segantii Capital has bought into the biggest deals and generated colossal fees for banks, making it a “priority customer” on Wall Street, according to a former prime broker in Hong Kong. “For years he was willing to be big, consistent, aggressive, a real risk-taker on blocks,” said a second counterparty at a global bank in the city. “Even across market cycles he never backed away. I knew that if I had something to sell that [Segantii] would give me their price.” A low-profile but lucrative corner of the finance industry, block trades are stock sales big enough to depress a company’s share price, meaning banks arrange them privately away from exchanges. Hedge funds typically buy the blocks at a discount, creating the chance to lock in a gain if the stock trades well after the sale but a loss if it does not. Since Sadler founded Segantii in 2007, it has become one of the biggest players in block trades in Asia — and it has rapidly expanded its reputation to trading floors in London and New York. Block trades have attracted scrutiny about how information is shared between buyers and sellers in advance of deals. US authorities are investigating how Wall Street banks handle the privately-negotiated sales, unsettling a market not accustomed to the spotlight. Suddenly, banks are becoming more risk averse. Last week, the Financial Times revealed that two of Segantii’s banks had cut off their previously-treasured client, preventing the hedge fund from trading equities with them globally. One of the banks also closed all of its accounts, including in prime brokerage and trading other financial products. Concerns among Bank of America’s markets supervision team in New York in early 2021 about trading by Segantii around blocks of shares placed on public markets by other banks led to an internal worldwide directive to sever ties with the hedge fund, according to two people familiar with the matter. © Jeenah Moon/Bloomberg At Bank of America, concerns among the investment bank’s markets supervision team in New York in early 2021 about trading by Segantii around blocks of shares placed on public markets by other banks led to an internal worldwide directive to sever ties with the hedge fund, according to two people familiar with the matter. The edict was “an extremely rare event for a fund of this size with a big name”, according to one of the people who is close to the bank. Meanwhile, Citigroup has suspended all equities trading with Segantii to reduce its exposure to the fund while block trades are in the headlights of US authorities, two other people said. It has continued to trade with Segantii in other products such as derivatives while other Wall Street banks, such as Goldman Sachs, have continued their relationships as normal. Segantii has not been accused of wrongdoing and it is not known if it has been contacted as part of the US block trades probe, but the banks’ moves were a rare roadblock for 52-year-old Sadler, whose ambitious risk-taking has reaped large rewards, both at his hedge fund and elsewhere. In 2019, Sadler bought his ailing hometown football club Blackpool FC for £10mn after years of relegation struggles and troubled finances. The club has since been promoted to the Championship, the division just below the Premier League. “All of a sudden, out of nowhere, I’m the owner of a football club, I’m walking on the pitch and people are singing my name. I’m getting soaked in champagne,” he said last year. When Sadler bought Blackpool FC he was described by The Guardian as a “local-boy-done-good”. Born in the seaside village of Bispham on the outskirts of Blackpool, he had a summer job renting out deckchairs before starting a financial career in the City of London. He later moved to Moscow and then Hong Kong, going on to be head of Asian equity trading for HSBC Securities. In 2019, Simon Sadler bought his ailing hometown football club Blackpool FC for £10mn after years of troubled finances. The club has since been promoted to the Championship © Catherine Ivill/Getty Images But he remained loyal to his hometown: when he started Segantii in Hong Kong in 2007 he named it after a pre-Roman Blackpool-based tribe, and designed its logo in the same tangerine as the Blackpool FC kit. In 2014, he bought the FA Cup winners’ medal of Sir Stanley Matthews — a former Blackpool player — at auction for £220,000. Sadler and his family relocated from Hong Kong to London during the pandemic, according to three people that know him. He has “pulled back” from Segantii’s main base in Hong Kong in the past few years, one of the people said, partly because of the focus on his football team. In the US, investigators have sought communications between Morgan Stanley — Wall Street’s biggest seller of block trades — and a number of its hedge fund counterparties, including a former employee of Segantii, according to media reports. In Hong Kong, Segantii is a “platform” for fiefdoms of different trading strategies, but with one “top dog who keeps an eye on everything”, according to one broker who works with the fund in London. The culture at the firm is hard charging, according to half a dozen counterparties and former employees who were interviewed by the FT, with one person close to the fund describing it as “highly political and highly territorial”. A sometimes “inhospitable” environment has extended to Segantii’s relationships with some of its brokers, according to several of the people interviewed. Two senior equity executives at global banks described receiving emails from Sadler that contained insults and expletives. “My last conversation with him was him telling us we were shit,” said one of the executives. A third executive, formerly a senior prime broker, said Sadler was “a tough character but I find him very fair. I go into each negotiation with him thinking ‘how little can I lose in this?’” Segantii and Sadler declined to comment for this article. On blocks, Segantii is a force of nature. It has a portfolio worth $3.5bn, according to its latest SEC filings. It buys big and quickly: over just two days in May, the fund acquired a 3.6 per cent stake in Avast, a provider of cyber security, and a 2 per cent stake in Meggitt, an aerospace group — both FTSE 100 companies. Block trading is one of the few businesses on Wall Street where deals still live or die on personal relationships. “If you’re a hedge fund and I’m not returning your call, you’re struggling,” said one former counterparty at a bank. “If you have a dialogue with a syndicate desk you have an informational advantage.” That “advantage” is where the potential risk lies. To negotiate a discount on a block trade, bankers have conversations with potential buyers, where they do not disclose the company involved, the identity of the seller or the deal’s structure. Such conversations can still tip off investors who may move to sell the stock. Technically, there has been no transfer of material nonpublic information — the red line at which laws are broken — but the legal grey area is vast. Hedge funds that take a lot of blocks off bankers will often expect to get “colour” — information that is not privileged but still provides helpful context — to get an edge on deals or expect to be reciprocated when banks are allocating shares on hot initial public offerings, according to syndicate bankers. And block trading is a lucrative business. Banks carried out more than $70bn of block deals in the US in 2021, according to Dealogic. The risk for Sadler is that the US probe has only just started to chill the block trade industry in which Segantii has built such a formidable reputation. “Lots of hedge funds have blocks guys now, but for Segantii this is their bread and butter,” said a portfolio manager in Hong Kong. Additional reporting by Arash Massoudi

BigHandsOliverKahn

Well-known member

Well he could always go back to hiring out deckchairs.For over a decade, bankers in Hong Kong wanting to sell large blocks of a company’s shares have jostled for the attention of Blackpool-born businessman Simon Sadler. Sadler’s $6bn hedge fund Segantii Capital has bought into the biggest deals and generated colossal fees for banks, making it a “priority customer” on Wall Street, according to a former prime broker in Hong Kong. “For years he was willing to be big, consistent, aggressive, a real risk-taker on blocks,” said a second counterparty at a global bank in the city. “Even across market cycles he never backed away. I knew that if I had something to sell that [Segantii] would give me their price.” A low-profile but lucrative corner of the finance industry, block trades are stock sales big enough to depress a company’s share price, meaning banks arrange them privately away from exchanges. Hedge funds typically buy the blocks at a discount, creating the chance to lock in a gain if the stock trades well after the sale but a loss if it does not. Since Sadler founded Segantii in 2007, it has become one of the biggest players in block trades in Asia — and it has rapidly expanded its reputation to trading floors in London and New York. Block trades have attracted scrutiny about how information is shared between buyers and sellers in advance of deals. US authorities are investigating how Wall Street banks handle the privately-negotiated sales, unsettling a market not accustomed to the spotlight. Suddenly, banks are becoming more risk averse. Last week, the Financial Times revealed that two of Segantii’s banks had cut off their previously-treasured client, preventing the hedge fund from trading equities with them globally. One of the banks also closed all of its accounts, including in prime brokerage and trading other financial products. Concerns among Bank of America’s markets supervision team in New York in early 2021 about trading by Segantii around blocks of shares placed on public markets by other banks led to an internal worldwide directive to sever ties with the hedge fund, according to two people familiar with the matter. © Jeenah Moon/Bloomberg At Bank of America, concerns among the investment bank’s markets supervision team in New York in early 2021 about trading by Segantii around blocks of shares placed on public markets by other banks led to an internal worldwide directive to sever ties with the hedge fund, according to two people familiar with the matter. The edict was “an extremely rare event for a fund of this size with a big name”, according to one of the people who is close to the bank. Meanwhile, Citigroup has suspended all equities trading with Segantii to reduce its exposure to the fund while block trades are in the headlights of US authorities, two other people said. It has continued to trade with Segantii in other products such as derivatives while other Wall Street banks, such as Goldman Sachs, have continued their relationships as normal. Segantii has not been accused of wrongdoing and it is not known if it has been contacted as part of the US block trades probe, but the banks’ moves were a rare roadblock for 52-year-old Sadler, whose ambitious risk-taking has reaped large rewards, both at his hedge fund and elsewhere. In 2019, Sadler bought his ailing hometown football club Blackpool FC for £10mn after years of relegation struggles and troubled finances. The club has since been promoted to the Championship, the division just below the Premier League. “All of a sudden, out of nowhere, I’m the owner of a football club, I’m walking on the pitch and people are singing my name. I’m getting soaked in champagne,” he said last year. When Sadler bought Blackpool FC he was described by The Guardian as a “local-boy-done-good”. Born in the seaside village of Bispham on the outskirts of Blackpool, he had a summer job renting out deckchairs before starting a financial career in the City of London. He later moved to Moscow and then Hong Kong, going on to be head of Asian equity trading for HSBC Securities. In 2019, Simon Sadler bought his ailing hometown football club Blackpool FC for £10mn after years of troubled finances. The club has since been promoted to the Championship © Catherine Ivill/Getty Images But he remained loyal to his hometown: when he started Segantii in Hong Kong in 2007 he named it after a pre-Roman Blackpool-based tribe, and designed its logo in the same tangerine as the Blackpool FC kit. In 2014, he bought the FA Cup winners’ medal of Sir Stanley Matthews — a former Blackpool player — at auction for £220,000. Sadler and his family relocated from Hong Kong to London during the pandemic, according to three people that know him. He has “pulled back” from Segantii’s main base in Hong Kong in the past few years, one of the people said, partly because of the focus on his football team. In the US, investigators have sought communications between Morgan Stanley — Wall Street’s biggest seller of block trades — and a number of its hedge fund counterparties, including a former employee of Segantii, according to media reports. In Hong Kong, Segantii is a “platform” for fiefdoms of different trading strategies, but with one “top dog who keeps an eye on everything”, according to one broker who works with the fund in London. The culture at the firm is hard charging, according to half a dozen counterparties and former employees who were interviewed by the FT, with one person close to the fund describing it as “highly political and highly territorial”. A sometimes “inhospitable” environment has extended to Segantii’s relationships with some of its brokers, according to several of the people interviewed. Two senior equity executives at global banks described receiving emails from Sadler that contained insults and expletives. “My last conversation with him was him telling us we were shit,” said one of the executives. A third executive, formerly a senior prime broker, said Sadler was “a tough character but I find him very fair. I go into each negotiation with him thinking ‘how little can I lose in this?’” Segantii and Sadler declined to comment for this article. On blocks, Segantii is a force of nature. It has a portfolio worth $3.5bn, according to its latest SEC filings. It buys big and quickly: over just two days in May, the fund acquired a 3.6 per cent stake in Avast, a provider of cyber security, and a 2 per cent stake in Meggitt, an aerospace group — both FTSE 100 companies. Block trading is one of the few businesses on Wall Street where deals still live or die on personal relationships. “If you’re a hedge fund and I’m not returning your call, you’re struggling,” said one former counterparty at a bank. “If you have a dialogue with a syndicate desk you have an informational advantage.” That “advantage” is where the potential risk lies. To negotiate a discount on a block trade, bankers have conversations with potential buyers, where they do not disclose the company involved, the identity of the seller or the deal’s structure. Such conversations can still tip off investors who may move to sell the stock. Technically, there has been no transfer of material nonpublic information — the red line at which laws are broken — but the legal grey area is vast. Hedge funds that take a lot of blocks off bankers will often expect to get “colour” — information that is not privileged but still provides helpful context — to get an edge on deals or expect to be reciprocated when banks are allocating shares on hot initial public offerings, according to syndicate bankers. And block trading is a lucrative business. Banks carried out more than $70bn of block deals in the US in 2021, according to Dealogic. The risk for Sadler is that the US probe has only just started to chill the block trade industry in which Segantii has built such a formidable reputation. “Lots of hedge funds have blocks guys now, but for Segantii this is their bread and butter,” said a portfolio manager in Hong Kong. Additional reporting by Arash Massoudi

Wizaard

Well-known member

That reads like Axe Capital in Billions.For over a decade, bankers in Hong Kong wanting to sell large blocks of a company’s shares have jostled for the attention of Blackpool-born businessman Simon Sadler. Sadler’s $6bn hedge fund Segantii Capital has bought into the biggest deals and generated colossal fees for banks, making it a “priority customer” on Wall Street, according to a former prime broker in Hong Kong. “For years he was willing to be big, consistent, aggressive, a real risk-taker on blocks,” said a second counterparty at a global bank in the city. “Even across market cycles he never backed away. I knew that if I had something to sell that [Segantii] would give me their price.” A low-profile but lucrative corner of the finance industry, block trades are stock sales big enough to depress a company’s share price, meaning banks arrange them privately away from exchanges. Hedge funds typically buy the blocks at a discount, creating the chance to lock in a gain if the stock trades well after the sale but a loss if it does not. Since Sadler founded Segantii in 2007, it has become one of the biggest players in block trades in Asia — and it has rapidly expanded its reputation to trading floors in London and New York. Block trades have attracted scrutiny about how information is shared between buyers and sellers in advance of deals. US authorities are investigating how Wall Street banks handle the privately-negotiated sales, unsettling a market not accustomed to the spotlight. Suddenly, banks are becoming more risk averse. Last week, the Financial Times revealed that two of Segantii’s banks had cut off their previously-treasured client, preventing the hedge fund from trading equities with them globally. One of the banks also closed all of its accounts, including in prime brokerage and trading other financial products. Concerns among Bank of America’s markets supervision team in New York in early 2021 about trading by Segantii around blocks of shares placed on public markets by other banks led to an internal worldwide directive to sever ties with the hedge fund, according to two people familiar with the matter. © Jeenah Moon/Bloomberg At Bank of America, concerns among the investment bank’s markets supervision team in New York in early 2021 about trading by Segantii around blocks of shares placed on public markets by other banks led to an internal worldwide directive to sever ties with the hedge fund, according to two people familiar with the matter. The edict was “an extremely rare event for a fund of this size with a big name”, according to one of the people who is close to the bank. Meanwhile, Citigroup has suspended all equities trading with Segantii to reduce its exposure to the fund while block trades are in the headlights of US authorities, two other people said. It has continued to trade with Segantii in other products such as derivatives while other Wall Street banks, such as Goldman Sachs, have continued their relationships as normal. Segantii has not been accused of wrongdoing and it is not known if it has been contacted as part of the US block trades probe, but the banks’ moves were a rare roadblock for 52-year-old Sadler, whose ambitious risk-taking has reaped large rewards, both at his hedge fund and elsewhere. In 2019, Sadler bought his ailing hometown football club Blackpool FC for £10mn after years of relegation struggles and troubled finances. The club has since been promoted to the Championship, the division just below the Premier League. “All of a sudden, out of nowhere, I’m the owner of a football club, I’m walking on the pitch and people are singing my name. I’m getting soaked in champagne,” he said last year. When Sadler bought Blackpool FC he was described by The Guardian as a “local-boy-done-good”. Born in the seaside village of Bispham on the outskirts of Blackpool, he had a summer job renting out deckchairs before starting a financial career in the City of London. He later moved to Moscow and then Hong Kong, going on to be head of Asian equity trading for HSBC Securities. In 2019, Simon Sadler bought his ailing hometown football club Blackpool FC for £10mn after years of troubled finances. The club has since been promoted to the Championship © Catherine Ivill/Getty Images But he remained loyal to his hometown: when he started Segantii in Hong Kong in 2007 he named it after a pre-Roman Blackpool-based tribe, and designed its logo in the same tangerine as the Blackpool FC kit. In 2014, he bought the FA Cup winners’ medal of Sir Stanley Matthews — a former Blackpool player — at auction for £220,000. Sadler and his family relocated from Hong Kong to London during the pandemic, according to three people that know him. He has “pulled back” from Segantii’s main base in Hong Kong in the past few years, one of the people said, partly because of the focus on his football team. In the US, investigators have sought communications between Morgan Stanley — Wall Street’s biggest seller of block trades — and a number of its hedge fund counterparties, including a former employee of Segantii, according to media reports. In Hong Kong, Segantii is a “platform” for fiefdoms of different trading strategies, but with one “top dog who keeps an eye on everything”, according to one broker who works with the fund in London. The culture at the firm is hard charging, according to half a dozen counterparties and former employees who were interviewed by the FT, with one person close to the fund describing it as “highly political and highly territorial”. A sometimes “inhospitable” environment has extended to Segantii’s relationships with some of its brokers, according to several of the people interviewed. Two senior equity executives at global banks described receiving emails from Sadler that contained insults and expletives. “My last conversation with him was him telling us we were shit,” said one of the executives. A third executive, formerly a senior prime broker, said Sadler was “a tough character but I find him very fair. I go into each negotiation with him thinking ‘how little can I lose in this?’” Segantii and Sadler declined to comment for this article. On blocks, Segantii is a force of nature. It has a portfolio worth $3.5bn, according to its latest SEC filings. It buys big and quickly: over just two days in May, the fund acquired a 3.6 per cent stake in Avast, a provider of cyber security, and a 2 per cent stake in Meggitt, an aerospace group — both FTSE 100 companies. Block trading is one of the few businesses on Wall Street where deals still live or die on personal relationships. “If you’re a hedge fund and I’m not returning your call, you’re struggling,” said one former counterparty at a bank. “If you have a dialogue with a syndicate desk you have an informational advantage.” That “advantage” is where the potential risk lies. To negotiate a discount on a block trade, bankers have conversations with potential buyers, where they do not disclose the company involved, the identity of the seller or the deal’s structure. Such conversations can still tip off investors who may move to sell the stock. Technically, there has been no transfer of material nonpublic information — the red line at which laws are broken — but the legal grey area is vast. Hedge funds that take a lot of blocks off bankers will often expect to get “colour” — information that is not privileged but still provides helpful context — to get an edge on deals or expect to be reciprocated when banks are allocating shares on hot initial public offerings, according to syndicate bankers. And block trading is a lucrative business. Banks carried out more than $70bn of block deals in the US in 2021, according to Dealogic. The risk for Sadler is that the US probe has only just started to chill the block trade industry in which Segantii has built such a formidable reputation. “Lots of hedge funds have blocks guys now, but for Segantii this is their bread and butter,” said a portfolio manager in Hong Kong. Additional reporting by Arash Massoudi

Hazi

Well-known member

A fact I didn't know the Segantii Tribe settling in Sunny Blackpool before the Romans!

www.blackpoolgazette.co.uk

www.blackpoolgazette.co.uk

Fylde's boggy marshes punctuated with islands of solid land

Local historian Barry McCann takes a fascinating look at ancient Fylde

NewburyOne

Well-known member

Sadler has done incredibly well for himself, I'm sure these stories are just minor bumps in the road for such companies. No doubt he will have crossed a few people as I'm positive he will not suffer fools gladly. He clearly surrounds himself with good people, in character and reputation. To hear some dissenting voices against a man that has done so much for Blackpool FC and the town, in such a short time, is quite staggering. I've no doubt the majority of fans feel like myself; extremely grateful and positive about the future.

Simon Sadler, you are one of our own!

Simon Sadler, you are one of our own!

JJpool

Well-known member

It's some high level stuff.That reads like Axe Capital in Billions.

The claims in the FT which are based on things that in part apparently happened over a year ago anyway, are disputed by that article I posted.

Even if those 2 banks, 1 of which apparently halted all trade and the other partially, did what was said.

There's many other big banks out there.

The FT even said a number of other banks including Goldman Sachs were still trading, why would they do that if there was any issues.

Tangerine Pip

Well-known member

Michael Prince now Keep upThat reads like Axe Capital in Billions.