Bought 1k of Nvidia shares after all the talk of ai and have doubled my money in a few months .Nearly cashed in last week but got advised ai is really going to take off and to hold as they could go 10 fold .Just booked another 2 cruises with carnival so got another £300 share perk as well as the price doubling

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

All stock investors out there......

- Thread starter seasideone

- Start date

Wouldn't go on a Cunard cruise very stuffy and very traditional and expensive and a older crowd .I never spent a penny on p&o and didn't always want to get off there was that much to do .Loads of younger people on .All sorts of bands and singers on in different venues every day .Cost me less than I spent in the UK in a cottage and ate and drunk much more and it was better .Proper free restaurants if you don't like the buffet and how much does it cost to eat out 3 or more times a day in the UK .Wouldn't go on a Cunard if it was free just not our type of shipYour last sentence is what I worry about coz it’s not like you can get off and go elsewhere. Will probably try one in the next year or so, thanks for your input

April13th1970

Well-known member

Blackpool-rocks

Well-known member

Decent day on the markets.

tangysider

Well-known member

So are banking shares finally out of the doldrums. Lloyds and Barclays up over 25% in a month

NewburyOne

Well-known member

I work for one of them, profits are insane thanks to high interest rates that aren't being passed on to savings. I bought extra LBG shares a few weeks ago at 41p, they're currently over 51p. I've seen forecasts saying they could reach anywhere between 55 and 65p this year. I certainly hope so!So are banking shares finally out of the doldrums. Lloyds and Barclays up over 25% in a month

tangysider

Well-known member

Unfortunately I bought in just before Putin invaded Ukraine so still in negative territory, but hoping for small returns, there was a time that share price was linked to profitability but a lot have risen recently where the parent group is saddled with huge debts.I work for one of them, profits are insane thanks to high interest rates that aren't being passed on to savings. I bought extra LBG shares a few weeks ago at 41p, they're currently over 51p. I've seen forecasts saying they could reach anywhere between 55 and 65p this year. I certainly hope so!

Three_Piers

Well-known member

Yeah nice jumpDecent day on the markets.

Three_Piers

Well-known member

Nvidia is a generational stock, maybe even lifetime. Not to tell you what to do with your money but I would be careful doing anything off the back of what somebody advises you. Nobody truly knows what the future holds.Bought 1k of Nvidia shares after all the talk of ai and have doubled my money in a few months .Nearly cashed in last week but got advised ai is really going to take off and to hold as they could go 10 fold .Just booked another 2 cruises with carnival so got another £300 share perk as well as the price doubling

There is still going to be lots of disruption in the AI field and that will include NVDA.

TangerineBayern

Well-known member

tangerine_neil

Well-known member

Lloyds is about one of the most boring shares around.So are banking shares finally out of the doldrums. Lloyds and Barclays up over 25% in a month

tangerine_neil

Well-known member

Genedrive.Is anyone looking at Genedrive GDR at the moment?

They’ve never managed to sell anything yet (hence price) but have clinical trials under way with the NHS for a testing kit that stops antibiotic induced deafness in babies.

I am hovering on this one as the upside is massive although it will depend on commercialisation

Now.

Now mate.

Check out the move today. The RNS. The presentation. If it gets the full recommendation in July, it will fly. Genuine chance of a x10 to x30 here.

I jumped in at 3.7p a few weeks ago.

tangerine_neil

Well-known member

Wish I’d bought Microstrategy about a year ago, which is essentially a Bitcoin tracker with added extras.

And same applies to Coinbase.

And same applies to Coinbase.

BIG_BERTHA_3

Well-known member

Watch it Sean you will be buying BFC nextI work for one of them, profits are insane thanks to high interest rates that aren't being passed on to savings. I bought extra LBG shares a few weeks ago at 41p, they're currently over 51p. I've seen forecasts saying they could reach anywhere between 55 and 65p this year. I certainly hope so!

NewburyOne

Well-known member

Ha, not quite in Mr Sadlers league but the 3 week profits will pay for my season ticket and as many away games as I can tolerate next season.Watch it Sean you will be buying BFC next

BIG_BERTHA_3

Well-known member

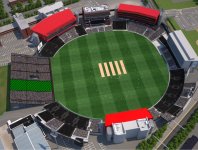

You sorted the cricket out 23rd AugHa, not quite in Mr Sadlers league but the 3 week profits will pay for my season ticket and as many away games as I can tolerate next season.

NewburyOne

Well-known member

Costero Poderoso

Well-known member

Brexit is sorted!!!!There is no doubt the FTSE is showing value, and hopefully now BREXIT is sorted and COVID maybe - it will benefit massively.

Think we are in for a bumpy ride though for the next few weeks with the markets.

BIG_BERTHA_3

Well-known member

Somewhere in thereWhereabouts are you and Daniel?

View attachment 18942

seasideone

Well-known member

I said hopefully back then - turned out not to be obviously!Brexit is sorted!!!!

Three_Piers

Well-known member

Tesla up 18% today after regulators in China pass deal for full self drive models. Tesla have reached an agreement with Chinese company Baidu (the chinese version of google) to power the new autonomous vehicle.

This is just the start of Tesla's journey into AI. There will be plenty of ups and downs but I believe the stock will be worth a hell of a lot more in 5 years time.

This is just the start of Tesla's journey into AI. There will be plenty of ups and downs but I believe the stock will be worth a hell of a lot more in 5 years time.

Costero Poderoso

Well-known member

I'll counter that with the prediction that Tesla will either not exist in ten years time, or will have been absorbed into a Chinese entity and exist as a brand name only.Tesla up 18% today after regulators in China pass deal for full self drive models. Tesla have reached an agreement with Chinese company Baidu (the chinese version of google) to power the new autonomous vehicle.

This is just the start of Tesla's journey into AI. There will be plenty of ups and downs but I believe the stock will be worth a hell of a lot more in 5 years time.

Three_Piers

Well-known member

With Musk anything is possible. There is huge potential but that also comes with risks. It's a speculative stock for sure. This is why you have plenty of diversity in a portfolio.I'll counter that with the prediction that Tesla will either not exist in ten years time, or will have been absorbed into a Chinese entity and exist as a brand name only.

I believe it will still be around and worth a lot more in 5 years time though.

GrahamwantshisOates

Well-known member

Closed half my short with Tesla to make a nice whopping profit. Didn’t expect the massive jump today.

Placed my short as I mentioned on page 1 of this thread in February 2021.

Placed my short as I mentioned on page 1 of this thread in February 2021.

Costero Poderoso

Well-known member

We'll see. However I'll add that the markets are no longer rational, so it's quite possible that Tesla will be one of those companies that is worth trillions and is a major stock pick right up to the day it falls off a cliff.With Musk anything is possible. There is huge potential but that also comes with risks. It's a speculative stock for sure. This is why you have plenty of diversity in a portfolio.

I believe it will still be around and worth a lot more in 5 years time though.

Possibly like most of its self driving cars will do.

GrahamwantshisOates

Well-known member

Anyone booked a World Cruise with my Tesla short tip which I regularly suggested?Yep I mentioned shorting Tesla on this thread a while back. See March 5th 2021 and Feb 25th 2021.

The bubble has popped and doing OK with my short

If anyone had taken my advise they would now be booking a World Cruise in a penthouse suite.

Thinking of buying though if drops below 150.

My post above in March 2024.

Three_Piers

Well-known member

As long as you skim the profits as you go along then it's all good.We'll see. However I'll add that the markets are no longer rational, so it's quite possible that Tesla will be one of those companies that is worth trillions and is a major stock pick right up to the day it falls off a cliff.

Possibly like most of its self driving cars will do.

Theoneandonly

Well-known member

Be careful. Going to China meant Musk now has no proprietary technology. The Chinese govt sponsors domestic firms when it wants to own a market. They subsidize so much that other countries can’t compete and businesses even really well run ones go bankrupt. Tesla can’t compete on price and their stock will reflect that in the next couple of years.Tesla up 18% today after regulators in China pass deal for full self drive models. Tesla have reached an agreement with Chinese company Baidu (the chinese version of google) to power the new autonomous vehicle.

This is just the start of Tesla's journey into AI. There will be plenty of ups and downs but I believe the stock will be worth a hell of a lot more in 5 years time.

seasideone

Well-known member

Seriously - why is the bolded bit correct?With Musk anything is possible. There is huge potential but that also comes with risks. It's a speculative stock for sure. This is why you have plenty of diversity in a portfolio.

I believe it will still be around and worth a lot more in 5 years time though.

…or is it just what the IFAs want you to believe??

Bill Ackman at Pershing Capital among many others is the arch enemy of your comments

Last edited:

seasideone

Well-known member

Just to add Warren and Charlie reckoned if you approached investing for you whole life , you should never be allowed to buy more than twenty stocks - you wouldn’t go far wrong.

The whole diversification bollox is designed to keep

IFAs in business and people who do not understand what they are buying.

The whole diversification bollox is designed to keep

IFAs in business and people who do not understand what they are buying.

Three_Piers

Well-known member

I have 22 stocks. That is diversified enough for me and not too much that I can't monitor what they are doing. I'm just saying I wouldn't go out there and buy 50 shares of tesla and nothing else.Just to add Warren and Charlie reckoned if you approached investing for you whole life , you should never be allowed to buy more than twenty stocks - you wouldn’t go far wrong.

The whole diversification bollox is designed to keep

IFAs in business and people who do not understand what they are buying.

Bloody IFAs, what bastards. Never met a good one.

Over-diversification is stupid, and the comfort blanket of terrible advisers who have all lost their clients untold amounts of money by allocating to the traditional 60/40 portfolio and similar and failing to do their jobs properly, instead choosing to cover their arses and tick some boxes so their compliance department don't give them any hassle.

BUT...

Self-managed portfolios tend to be heavily weighted to equities, which could be right for some clients, but they tend to vastly underperform during market turbulence for that reason. As much as everybody thinks they can time the market - believe me, you can't. In a bull market helped along by unprecedented depreciation of currencies all around the world, when everybody's making money, it's also easy to fall into the trap of thinking you're a genius because everything's going up. Overconfidence leads to bad things, the market will humble you eventually.

IFAs do a lot more than just asset allocation, or they should do. There's an enormous amount of other "stuff" that goes into proper financial planning and that's why people who manage their own investments tend to be worse off in the long run. Not everybody, of course, some people genuinely are good at it, but there's a reason investment managers get paid the big bucks and people who self-manage tend to end up not reaching their goals, most don't even define their goals in the first place.

There are a lot of bad advisers out there, in fact I'd say it's a majority unfortunately, but there's a place for proper financial planning, and most people need it. There are just too many bad apples giving the rest of us a bad name.

Anyway, you're all doing great, unless like me you've held Tesla through this drop! Long term play that one, though..

Over-diversification is stupid, and the comfort blanket of terrible advisers who have all lost their clients untold amounts of money by allocating to the traditional 60/40 portfolio and similar and failing to do their jobs properly, instead choosing to cover their arses and tick some boxes so their compliance department don't give them any hassle.

BUT...

Self-managed portfolios tend to be heavily weighted to equities, which could be right for some clients, but they tend to vastly underperform during market turbulence for that reason. As much as everybody thinks they can time the market - believe me, you can't. In a bull market helped along by unprecedented depreciation of currencies all around the world, when everybody's making money, it's also easy to fall into the trap of thinking you're a genius because everything's going up. Overconfidence leads to bad things, the market will humble you eventually.

IFAs do a lot more than just asset allocation, or they should do. There's an enormous amount of other "stuff" that goes into proper financial planning and that's why people who manage their own investments tend to be worse off in the long run. Not everybody, of course, some people genuinely are good at it, but there's a reason investment managers get paid the big bucks and people who self-manage tend to end up not reaching their goals, most don't even define their goals in the first place.

There are a lot of bad advisers out there, in fact I'd say it's a majority unfortunately, but there's a place for proper financial planning, and most people need it. There are just too many bad apples giving the rest of us a bad name.

Anyway, you're all doing great, unless like me you've held Tesla through this drop! Long term play that one, though..

GrahamwantshisOates

Well-known member

I learn’t the hard way during the internet bubble 99/00.Bloody IFAs, what bastards. Never met a good one.

Over-diversification is stupid, and the comfort blanket of terrible advisers who have all lost their clients untold amounts of money by allocating to the traditional 60/40 portfolio and similar and failing to do their jobs properly, instead choosing to cover their arses and tick some boxes so their compliance department don't give them any hassle.

BUT...

Self-managed portfolios tend to be heavily weighted to equities, which could be right for some clients, but they tend to vastly underperform during market turbulence for that reason. As much as everybody thinks they can time the market - believe me, you can't. In a bull market helped along by unprecedented depreciation of currencies all around the world, when everybody's making money, it's also easy to fall into the trap of thinking you're a genius because everything's going up. Overconfidence leads to bad things, the market will humble you eventually.

IFAs do a lot more than just asset allocation, or they should do. There's an enormous amount of other "stuff" that goes into proper financial planning and that's why people who manage their own investments tend to be worse off in the long run. Not everybody, of course, some people genuinely are good at it, but there's a reason investment managers get paid the big bucks and people who self-manage tend to end up not reaching their goals, most don't even define their goals in the first place.

There are a lot of bad advisers out there, in fact I'd say it's a majority unfortunately, but there's a place for proper financial planning, and most people need it. There are just too many bad apples giving the rest of us a bad name.

Anyway, you're all doing great, unless like me you've held Tesla through this drop! Long term play that one, though..

I listened to the so called experts “ Buy, Baltimore technology, 365 Corporation,Telewest communications etc” and I did.

Made a great profit until the inevitable crash in March 2000.

I kept buying as they fell like a stone thinking they were a bargain. It was pure greed on my side which backfired.

The majority went bust( including the examples above) and I lost heavily.

I am wiser now and identified that the Tesla craze was going the same way a couple years or so back. Not saying they will go bust but massively over valued at the time. Against the “experts” advice I shorted from around 800 and now around 180 and sold half a couple days back.

Certainly made my money back

seasideone

Well-known member

Looking after your own money is common sense to me, as in reality I care more about it than anyone else.

I also think you need to get a proper financial education on how to pick companies and investments - and realise they will still not all work.

I pay for access to analysts and fund managers in a US Hedge Fund, that helps me massively.

One question I ask all IFAs is do your previous results out perform the S&P 500 index?

If not (and I am yet to meet one who can), and you do not know what you are doing, you are better just buying a cheap S&P 500 tracker from either Vanguard or ishares and forgetting about it for min of 5years and ideally longer.

Just to add I know Magic147 who is an IFA and a good bloke

I also think you need to get a proper financial education on how to pick companies and investments - and realise they will still not all work.

I pay for access to analysts and fund managers in a US Hedge Fund, that helps me massively.

One question I ask all IFAs is do your previous results out perform the S&P 500 index?

If not (and I am yet to meet one who can), and you do not know what you are doing, you are better just buying a cheap S&P 500 tracker from either Vanguard or ishares and forgetting about it for min of 5years and ideally longer.

Just to add I know Magic147 who is an IFA and a good bloke

One question I ask all IFAs is do your previous results out perform the S&P 500 index?

This is an interesting point and actually cuts to the heart of the problem in the entire discussion. The question itself ignores all of that "other stuff" that an IFA should be doing for clients, ie. actual financial planning, and therein lies the problem - there's a fundamental disconnect and a lack of understanding generally about what an IFA does and how they can add value - I say can as I'm assuming of course they're not just operating as a fee hoover and offering very little in return, and I wish the number of those advisers in the profession was lower.

It also ignores a key part of financial planning - risk management. What are we comparing to, the portfolio that an adviser would recommend for a balanced risk investor? One designed for a more adventurous investor? What risk rating system are we using, and have we considered the client's capacity for loss in this risk discussion? If we're comparing an index of the 500 largest companies in America (note the 100% equity allocation that this implies as discussed above...), then what position does that put somebody invested in this in during market downturns? The S&P was down 18.11% in 2022. What if I planned to retire in January 2023?

Let's compare returns of the S&P index to an investment firm headed by two (now one) of what many people consider to be the most successful investors of their generation, Berkshire Hathaway, run by the incredible financial minds of Warren Buffett and Charlie Munger (RIP).

Let's use the "S&P filter" - if they don't outperform the S&P, they can piss off, right? Idiots!

Well, in the 10 years from 2014 up to and including 2023, the S&P returned an average of 13.1%. Pretty good, but I reckon old Warren and Charlie will have absolutely destroyed that!

Berkshire averaged 12.5% over that same period. Complete morons! Surely nobody should take advice from these people.

Well, thousands of people will tune in to the annual Berkshire Hathaway shareholders meeting on Saturday to listen to the opinions of Warren Buffett, ask him questions about the firm and try to glean what wisdom they can from the limited time. Maybe we should tell them all to stop wasting their time and just stick everything in an S&P tracker..

Looking at 2022 again, whilst the S&P was losing 18.11%, Berkshire was 4% up that year - imagine being an adviser who had recommended an S&P tracker carrying out an annual review in January 2023 - you'd have some very difficult questions to answer!

Anyway, I jest - of course I know people who very successfully manage their own money and whenever I hear about it I love it - it's a fantastic skill to have, but not everybody can do it, or even learn to do it, have the time to learn etc. These days there are some great retail-focused platforms and access to all manner of market intelligence so it's more possible than it's ever been. But, for people who want to take advice from the professionals, that also exists. You can do your own accounts, yet accountants exist. You can cut your own hair (easier for some than others!), yet barbers exist. You can load up your latest save of Football Manager and get Blackpool into the Champions League, yet Neil Critchley exists...

Opinionhated

Well-known member

Quite a few years ago we invested in DAZ, had strong advice was the best. My wife tells me it was the right decision and never looked back. Always looked at the markets and felt hot under the collar at times.