Tangerinenick

Well-known member

In Truss we trust.

Tough job ahead .

Doomed.

Tough job ahead .

Doomed.

Labour have got it right and tax the energy firms , at the same time as hopefully trying to get the energy back into the public domain .So who do you want to pay for it ?

All well and good, but they've just appointed Rees Mogg as Energy Minister who is against green energy and wants to bring back fracking but only in certain areas (the North), and doesn't believe in climate change.If the plan is to cap the price of a unit of energy, then I'd say that's the best outcome for now.

Truss mentioned long term problems with energy, and what I'd like to see is significant investment in green/renewable energy on a scale we haven't yet seen. For two reasons. The first is obvious - clearly if anything this crisis has shown is that the faster we can eliminate any dependence on gas and oil the better for our economy. Secondly, renewable energy can actually be a catalyst for growth.

Regarding the national debt debate, both Labour and the Tories have had to deal with significant global shocks in the last fifteen years. The banking crisis, the Covid crisis and now the energy crisis. Unfortunately, the only realistic solution for all three were (or will be) exceptionally expensive not just for us but for pretty much every country. Using them as political point scoring by either side is a pretty futile exercise imo. What I'd like to see from this government is the intention to control the debt in a way that doesn't cut spending harmfully. What I mean is, we don't need a budget surplus, we only need to manage the deficit sufficiently that it reduces the national debt as a % of GDP. In a growing economy, that actually means the debt can also grow, and you can also run a deficit.

Clearly the economy needs a kick start, and while the new PM has a fairly straightforward decision in the short term (let's be honest, she has little choice but to introduce some kind of energy price cap), the really big and important decision she has to get right is what catalyst to use to get the economy growing. I'm not sure tax cuts alone will do it, investment is required I think.

It's what I'd like to see, not what I think we'll see under the Tories.All well and good, but they've just appointed Rees Mogg as Energy Minister who is against green energy and wants to bring back fracking but only in certain areas (the North), and doesn't believe in climate change.

What can possibly go wrong?

don't forget that the Chinese and the French have been guaranteed a very high supply price when they come on stream with their new nuclear facilities - and - the chinese have to be given the opportunity to build further nuclear plants in the UK.I'm sure future governments will look at getting the money back, energy generation costs have not increased.

Essentially the proposal is that instead of paying for energy companies massive profits now, you and I pay for the energy extraction companies massive profits over the next 20 years.

Why?don't forget that the Chinese and the French have been guaranteed a very high supply price when they come on stream with their new nuclear facilities - and - the chinese have to be given the opportunity to build further nuclear plants in the UK.

Why have they been guaranteed the prices - because that was the deal that May (and Cameron before her) agreed to in exchange for the Chinese / EDF building the plantsWhy?

Capping the energy price today to simply increase it in the future will actually make the current energy problems worse; there is a long explanation but it comes down to how energy is being rentier-ed, ie turned purely into an asset class, and, that UK energy is predominantly in the hands of foreign entities, including hostile foreign powers. Profits that are guaranteed for the future makes the asset class look undervalued in the short term which would have an additional upward impact on pricing in the medium term to meet shareholder expectations, and the UK has devolved its responsibility in the energy market to the profitisation process. As it has in other utilities, Banking and finance, Telecoms (data), transport, infrastructure.If the plan is to cap the price of a unit of energy, then I'd say that's the best outcome for now.

Truss mentioned long term problems with energy, and what I'd like to see is significant investment in green/renewable energy on a scale we haven't yet seen. For two reasons. The first is obvious - clearly if anything this crisis has shown is that the faster we can eliminate any dependence on gas and oil the better for our economy. Secondly, renewable energy can actually be a catalyst for growth.

Regarding the national debt debate, both Labour and the Tories have had to deal with significant global shocks in the last fifteen years. The banking crisis, the Covid crisis and now the energy crisis. Unfortunately, the only realistic solution for all three were (or will be) exceptionally expensive not just for us but for pretty much every country. Using them as political point scoring by either side is a pretty futile exercise imo. What I'd like to see from this government is the intention to control the debt in a way that doesn't cut spending harmfully. What I mean is, we don't need a budget surplus, we only need to manage the deficit sufficiently that it reduces the national debt as a % of GDP. In a growing economy, that actually means the debt can also grow, and you can also run a deficit.

Clearly the economy needs a kick start, and while the new PM has a fairly straightforward decision in the short term (let's be honest, she has little choice but to introduce some kind of energy price cap), the really big and important decision she has to get right is what catalyst to use to get the economy growing. I'm not sure tax cuts alone will do it, investment is required I think.

Yep, some very good points.Capping the energy price today to simply increase it in the future will actually make the current energy problems worse; there is a long explanation but it comes down to how energy is being rentier-ed, ie turned purely into an asset class, and, that UK energy is predominantly in the hands of foreign entities, including hostile foreign powers. Profits that are guaranteed for the future makes the asset class look undervalued in the short term which would have an additional upward impact on pricing in the medium term to meet shareholder expectations, and the UK has devolved its responsibility in the energy market to the profitisation process. As it has in other utilities, Banking and finance, Telecoms (data), transport, infrastructure.

The recent global shocks were predictable, and inevitable. Obama amongst others around 2010 had predicted that we hadn’t had a global pandemic for a hundred years and that the world should prepare for one. The energy crisis has been looming for twenty years or more, the banking crisis was a very obvious problem before it happened, we had already had two fairly significant crisis’ since de-regulation. In each case funding to understand or regulate against these issues has been reduced / removed either; in the pursuit of short term profit or to maintain short term profit. You forget the self-harm of Brexit as well which was largely avoidable, even to the point of saying that any deal that wasn’t centred entirely on the fairyland desires of the ERG and few nut jobs in UKIP should be rejected.

Sovereign debt isn’t really that big an issue as long as the debt can be serviced as you say. However moving away from a productive economy to one that is largely rentier as the UK is and has been doing for forty years – is a sure-fire way to create debt problems, because rising asset values don’t contribute to GDP (if GDP is even a reasonable measure of economic success or stability).

You cannot continually run a budget deficit either, as much as economists think you can, at some point comes a wall of reality butting up against theories of debt based economics, that’s the thing that causes crashes.

The only way you can kick start a consumptive economy which is the economy we actually exist in is ensuring the participants can consume. Consumption has been guaranteed for the last thirty – thirty five years through cheap credit, and in that time we have had two small financial crisis’ and one that was almost existentially threatening. So the only way to ensure consumption is to make sure that consumer have the wherewithal to consume, which means putting money into the hands of consumers; but the traditional view is that that increases inflation so there is a rock and a hard place (personally I’m not convinced by the inflation arguments in this respect) that has to be overcome. BUT . . . . reducing taxes, encouraging investment in assets, de-regulating to profitisation models, and undermining worker’s rights takes actual money out of the consumptive process which if debt is now more expensive you commit 60-70% of the population to needs based consumption and in many cases not enough for even absolute needs.

Like you say this isn’t a party political problem –the momentum-esque socialism isn’t going to fix it either, but what Truss is proposing is simply going to make things much worse, much more quickly, it’s just another layer of idiocy that massively benefits maybe 2% of the population. Anyone that works is going to be f***ed, anyone with a small or medium sized business is going to be f***ed, anyone with a private pension is going to be f***ed.

Or give the contracts to someone else. We used to lead the world in technology.Why have they been guaranteed the prices - because that was the deal that May (and Cameron before her) agreed to in exchange for the Chinese / EDF building the plants

Why should we not forget - because the prices agreed were at the time considered to be so far beyond the prediction of energy prices that at the time it was considered stupidly exorbitant. Any chance that energy prices will be or can be lowered has to be looked at in the context of Chinese / French production of electricity in the UK with a capacity of around 20 -30 % of the market, and any UK government having any ability to break that agreement is effectively zero. Basically profits are guaranteed by the UK Government to secure supply.

Nope. We've had a deficit every single year of the Conservative government. Our debt was 3x larger than what Cameron and Osborne pledged it would be by the end of their first term and we were supposed to be in surplus by 2018. They failed.

So, you've shown our tax receipts went down. Now, are you seriously suggesting loss in tax income is the only effect of a global economic crisis? Not one single other thing may cause extra spending too? Like, you know, the rise in unemployment?

So, it didn't disappear. And for the third time, they failed didnt they. The Conservatives came out with all this bluster about magic money trees and how having a deficit is financial mismanagement and they had one every single year of their rule. They said they would be in surplus by 2018 and they failed. They deficit even grew between 2018 and 2019, before the pandemic.Sorry for the delay, needed to check a few facts.

Almost gone by 2019, then Covid came along and f***ed things up again.

Budgeted spending (including capital) 2004/05 was £485 billion, with a non-trivial £30bn deficit, by 2010/11 that'd grown to £702bn with a £161 deficit, of which maybe, being generous, 10% of the TWO HUNDERD AND SEVENTEEN BILLION of additional government spending might relate to the banking crisis, I'd suggest that a 45% increase in government spending over 7 years would be wildly profligate in any circumstances let alone against a background of declining tax revenues, and the vast majority of the spending was unrelated to the banking crisis, and was likely very poorly spent as well.

I have the detailed numbers if you want to check.

So, for the third time, they failed didnt they. The Conservatives came out with all this bluster about magic money trees and how having a deficit is financial mismanagement and they had one every single year of their rule. They said they would be in surplus by 2018 and they failed. They deficit even grew between 2018 and 2019, before the pandemic.

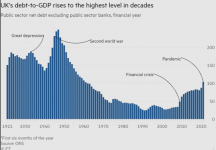

Now, take a look at this debt-to-gdp graph and tell me at what point it was out of control. Look at that 10 year period between 1997 and 2007 and see how it's a) it's lowest point and b) almost completely flat.

View attachment 12823

It's called general taxation. Look beyond your wage slip and see VAT, corporation tax, NI, fuel and tobacco duties, import taxes and various others. The state also has the power to issue bonds which can be dated as long as chosen. There is no magic money tree it's all perfectly simple state creation as all money is. All else is credit which is ~97% of all money.Just exactly how did Keir Starmer intend to repay it? Maybe the return of 'the magic money tree.' I could do with that right now.

No you haven't. You firstly said there was no impact of the crash on spending and then when you realised how absurd that is from the slightest pushback of literally one example of unemployment spend, you said 'it probably accounts for 10%' which is a number plucked out of thin air. You've also made a severe error in how you've calculated falling tax revenues. You've said a 40 bn loss, which in absolute terms is right, but tax revenues were rising ever year, sometimes by up to 40bn. So if tax returns were at 400bn and were on course to go up to 440bn, but because of a global financial crash fall to 360bn, you've lost 80bn. Not 40.I've already explained to you why the debt/gdp ratio was going up, it was because of Brown's £217 billion spending spree, which left us with a £160 billion annual deficit, which then got dumped into Cameron & Co's lap and took years to sort out, if you can't grasp that then so be it.

You mean the bank bail outs don't you? Tell me how come the state has to bail out the private sector, why isn't it the other way round if they're so goddamn efficent? They're rentiers.I've already explained to you why the debt/gdp ratio was going up, it was because of Brown's £217 billion spending spree, which left us with a £160 billion annual deficit, which then got dumped into Cameron & Co's lap and took years to sort out, if you can't grasp that then so be it.

there are massive penalties running into the billions but it would in the long term be better if the contracts were cancelled. May had the opportunity to cancel them but chose not to.Or give the contracts to someone else. We used to lead the world in technology.

You mean the bank bail outs don't you? Tell me how come the state has to bail out the private sector, why isn't it the other way round if they're so goddamn efficent? They're rentiers.

Do a graphNothing of the sort.

Scaremonger.

The banks were bust and cash points were about to cease functioning the whole world economy was about to crash. We forget how close we came to financial armageddon and Brown played a large part in avoiding that outcome. So tell me, what did Brown spend the money on if not bank bailouts and where did the money really go. I'll wait.Nothing of the sort.

Yeah he totally forgot about bank bailout spendingThe banks were bust and cash points were about to cease functioning the whole world economy was about to crash. We forget how close we came to financial armageddon and Brown played a large part in avoiding that outcome. So tell me, what did Brown spend the money on if not bank bailouts and where did the money really go. I'll wait.

The banks were bust and cash points were about to cease functioning the whole world economy was about to crash. We forget how close we came to financial armageddon and Brown played a large part in avoiding that outcome. So tell me, what did Brown spend the money on if not bank bailouts and where did the money really go. I'll wait.

Yeah he totally forgot about bank bailout spending

I've read through the budgets in detail, not one penny AFAICS relates to "banking bailouts" (not for 2009/10 anyway).

Once again ignoring the positivity in the post, who cares who posts it as long as it factual.Scaremonger.

You have the uncanny ability to dig up more and more lunatics.

Kimbell makes rwnjs look moderate.

He should stick to looking for the One Armed Man.

No you haven't. You firstly said there was no impact of the crash on spending and then when you realised how absurd that is from the slightest pushback of literally one example of unemployment spend, you said 'it probably accounts for 10%' which is a number plucked out of thin air. You've also made a severe error in how you've calculated falling tax revenues. You've said a 40 bn loss, which in absolute terms is right, but tax revenues were rising ever year, sometimes by up to 40bn. So if tax returns were at 400bn and were on course to go up to 440bn, but because of a global financial crash fall to 360bn, you've lost 80bn. Not 40.

You've called a 45% rise in spending as wildly profligate, so what about the 78% increase in gdb per capita in that 7 years too? At a time when debt-dgp was at its lowest point in 100 years? Please explain how that extra spending was hurting the economy.

This is all really besides the point anyway, because as I've said worrying about the debt and deficit is stupid. My point was the Tories came in demonising Labour's deficits and promising to eliminate it. And they failed. Can you accept that now you've looked up your incorrect numbers?

Or a period of a planned, command economy.If the plan is to cap the price of a unit of energy, then I'd say that's the best outcome for now.

Truss mentioned long term problems with energy, and what I'd like to see is significant investment in green/renewable energy on a scale we haven't yet seen. For two reasons. The first is obvious - clearly if anything this crisis has shown is that the faster we can eliminate any dependence on gas and oil the better for our economy. Secondly, renewable energy can actually be a catalyst for growth.

Regarding the national debt debate, both Labour and the Tories have had to deal with significant global shocks in the last fifteen years. The banking crisis, the Covid crisis and now the energy crisis. Unfortunately, the only realistic solution for all three were (or will be) exceptionally expensive not just for us but for pretty much every country. Using them as political point scoring by either side is a pretty futile exercise imo. What I'd like to see from this government is the intention to control the debt in a way that doesn't cut spending harmfully. What I mean is, we don't need a budget surplus, we only need to manage the deficit sufficiently that it reduces the national debt as a % of GDP. In a growing economy, that actually means the debt can also grow, and you can also run a deficit.

Clearly the economy needs a kick start, and while the new PM has a fairly straightforward decision in the short term (let's be honest, she has little choice but to introduce some kind of energy price cap), the really big and important decision she has to get right is what catalyst to use to get the economy growing. I'm not sure tax cuts alone will do it, investment is required I think.

Pleased with what’s been done, but I’ll see how the business relief pans out in the coming months - if she’s got this wrong, then it will be an economic catastrophe! no point in ’getting the economy going’ if there’s no where to spend your money….. our business is tied in until May 23, just been enquiring on current pricing and we’d go from circa £16k per year to around £42k per year! Utter madnessIt doesn’t look like we pay it back individually. It looks like it will be recovered through taxes.

Similar to Starmers proposal in many ways though full details probably not know until Thursday.

An improvement on what we thought we were facing individually for sure.

I won’t say no and doubt many would and I believe the rate fixed for business too which will be a blessing for many.

My number was referring to gdp per capita on based on current prices https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?end=2007&locations=GB&start=2000&view=chart. I wasn't saying the economy grew by 74% in 7 years, it was inelegantly put. My point was you have no substance behind saying borrowing was 'wildly profligate' as if it was some sort of terrible thing, when the economy was growing, and our debt to gdp ratio was hovering around near record lows. Billions of debt sounds scary until you realise our GDP was 4x larger and as a percentage of GDP it had barely ever been lower.Where do you get that number from, if the economy really was growing by 8.6% per annum for seven years people might've noticed, IMF says the following (historic prices, GBP) (you may need to re-run the search):

which is a 26.0% rise over the seven-year period, and in fact only 74.4% over the entire 13 years of Labour's rule, so 78% is exactly three times the true figure.

- 1997: 951,750;

- 2004: 1,317,459;

- 2011: 1,660,141;

Your question should of course have alerted you that the number was wrong anyway, because if GDP growth had genuinely been that much above the rate of increase in spending, then he would've left a massive surplus and not the £160bn deficit that you accept he left.

As to the rest, the phrase "fix the roof while the sun is shining" applies, but of course he'd convinced himself that he'd abolished "boom and bust" so was happy to ride the credit bubble for all it was worth, and when that burst, and he knew that tax revenues would not support the level of spending he wanted, he continued to spend like nothing had happened anyway (a staggering £83bn in the final two budgets alone).

The same tree that's kept thousands of people in a job through a pandemic probably.

Two words. Northern Rock

Read the entire chapter 3.

Remember this is just a budget. Not what was actually spent. For actual end of year expenditure you want this - where you can see how much was spent on bailing out the banks in 08/09 and 09/10. https://www.theguardian.com/news/datablog/2010/may/17/uk-public-spending-departments-money-cuts. Just £130bn in two years.

Did you seriously think the UK government didn't spend any money on bank bailouts?

You keep repeating this as if it were true, but, in macro economic terms, at country level, it is not true, as we have discussed ad nauseam. Thatcher was wrong, countries do not have to balance their budgets like a household. Households cannot create money, a country can. Past QE has not lead to the inflation that your discredited view expects.Yes, it would be interesting to note the response on this board if the Government hadn't issued furlough payments during lockdown.

I would suggest that the very people complaining about the money tree would be calling for the Government to make/increase furlough payments if they were not satisfied.

It's also interesting to see the people who used to preach to us about the need to lockdown are now complaining about the cost of the lockdown that they called for, supported and would have extended.

There is no such thing as a free lunch.

You keep repeating this as if it were true, but, in macro economic terms, at country level, it is not true, as we have discussed ad nauseam. Thatcher was wrong, countries do not have to balance their budgets like a household. Households cannot create money, a country can. Past QE has not lead to the inflation that your discredited view expects.

Good afternoon, 2020, I trust you are well today.Morning Moss

I was not aware that I had kept repeating anything.

YOU have chosen to express views on Thatcher as you are perfectly entitled to do.

The views I expressed were on the Government's lockdown policy of 2020-21, nearly 30 years after Thatcher had left office and 7 years after she had stopped breathing.

YOU have also chosen to express views on quantitative easing and inflation, again you are perfectly entitled to express such opinions but all I did was question the response of the posters who are now complaining about the Government's money tree if the Government had not financially supported the lockdown in the manner that they did.

Although I have not offered opinion on Thatcher or inflation, my view - my "discredited view" - is that the Government did not handle some of the things associated with Covid very well.

I'd imagine that I will hold and express personal opinions on certain matters that will be in line with some posters and opinions on other matters that are not, I'm not sure why you haven chosen to talk of my "discredited view" ?

Perhaps some of the views that I have expressed on this forum just happen to differ from those of your good self ?

Good afternoon, 2020, I trust you are well today.

The point I was taking issue with is your last line, and, tbf, have avidly read your long and detailed responses for as long as you have been on the board with this name.

At a country level, there is such a thing as free lunch, a fact that the grey eminence of current Tory Party and ERG, Keith Joseph, failed to grasp.

Have to agree with that. Economic opinions are like backsides ( you know the rest!!)Not a criticism - in fact, I think that you will probably agree ? - but I'd imagine that there will be folk that are more knowledgeable than you on economics who don't agree with your opinions on some economic matters.

Have to agree with that. Economic opinions are like backsides ( you know the rest!!)

Support during the pandemic was enormous, like during the banking crisis. Neither affected inflation to any discernible extent. Economists are puzzled by this, as it goes against their theories, hence why I call it discredited. You are correct, many economists will not, perhaps cannot agree with this. However, as a scientist, if the evidence does not support the theory, the theory is wrong.

Hey, don't apologise, you had a different view, just as valid as mine in the great scheme of things. That's democracy, thank goodness.Fair enough Moss.

I was not really considering any complex economic theory when I offered my tuppence halfpenny worth but I apologise for overreacting to your response.

Yes and who I will pay the extra taxes. Me and you. Ever get the feeling we are being cheated, again and again.It doesn’t look like we pay it back individually. It looks like it will be recovered through taxes.

Similar to Starmers proposal in many ways though full details probably not know until Thursday.

An improvement on what we thought we were facing individually for sure.

I won’t say no and doubt many would and I believe the rate fixed for business too which will be a blessing for many.